Politicians and central bankers assure us that they are diligently “fighting” inflation. Actually, they are fighting inflation the same way that an arsonist fights against the fires he just set. Government is the inflation arsonist.

April 22, 2025

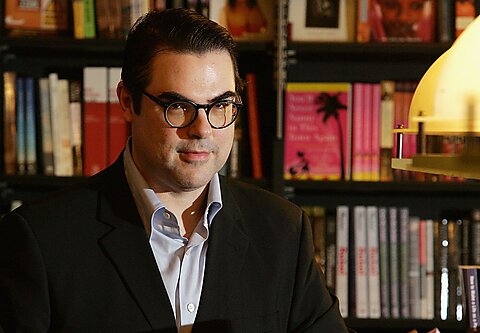

I am saddened to report that my good friend James L. Swanson died of a rare form of brain cancer yesterday in his hometown of Chicago. He was 66. In 2001, James came on board Cato to create and serve as the first editor-in-chief of the Cato Supreme Court Review, which we released on September 17, 2002, at Cato’s inaugural Constitution Day Symposium, which he organized. From the start, when Constitution Day was barely known, both the annual review and the symposium have been highly regarded in Washington’s legal community. Credit goes to James for securing everything from the cases to be covered to the authors to do so, the editing, the initial publication arrangements—even the federal colors of the review’s cover—and the distinguished speakers for the symposium.

After two rounds of the review and symposium, we lost James to the larger publishing world as he was under intense pressure to complete the manuscript that would become a New York Times best-seller: “Manhunt: The 12-Day Chase for Lincoln’s Killer.” More recently, an Apple TV + series, on which James worked closely, was based on the book.

With an undergraduate degree in history from the University of Chicago and a law degree from UCLA, James went on to become a Lincoln scholar of the first order and a collector of Lincoln memorabilia. Indeed, he was born on February 12, 1959, exactly 150 years after Lincoln’s birth. And his death has come exactly 160 years after the day that the train carrying Lincoln’s body left Washington for Illinois.

A simple search will show the many well-reviewed books James has written over the years and the extraordinary range of his interests—quite apart from his work in the 1990s as the editor of the First Amendment Law Handbook. And all of that was accomplished while he served two terms as a senior official in the Justice Department and served also as a clerk for Judge Douglas Ginsburg during the judge’s first year on the US Court of Appeals for the District of Columbia Circuit.

For those of us at Cato old enough, however, it is not only James’ prodigious knowledge or his dedication to the work before him that we will remember, but his little chuckle after uttering a bon mot and the warm smile that followed that we will most cherish. Rest in peace, good friend.

Post Content

The UK government has been accused of “sabotaging” its own tourism industry after new figures revealed that international visitor spending fell by more than £2 billion in 2024 compared to pre-pandemic levels, despite a global recovery in travel.

According to the World Travel and Tourism Council (WTTC), overseas visitors spent £40.3 billion in the UK last year, a 5.3 per cent drop from 2019. The council warned that the shortfall reflects deliberate policy decisions that have created barriers for international travellers and damaged the UK’s competitiveness as a global destination.

Julia Simpson, president of the WTTC and a former adviser to Tony Blair, said the government had failed to prioritise a sector that contributes 10 per cent of UK GDP. “This government is all about growth. Yet here we have a private sector enterprise, travel and tourism, contributing 10% of UK GDP, creating jobs, but we are not prioritising it in any way. We are sabotaging ourselves,” she said.

Simpson pointed to several government actions she said were holding back recovery, including the removal of VAT-free shopping for tourists, the rise in air passenger duty, and the introduction of electronic travel authorisations (ETAs) — a £16 charge now required for most European visitors. She also criticised the decision to slash VisitBritain’s promotional budget by 44 per cent, from £18.85 million to £10.57 million at the start of April.

Retailers, particularly in the luxury sector, have echoed the WTTC’s concerns. Burberry’s chief executive has previously said that ending the VAT rebate has placed the UK at a competitive disadvantage for high-spending global shoppers. Simpson added that Britain is losing market share to European neighbours that continue to offer incentives to international visitors.

In her comments, Simpson stressed the importance of storytelling and destination marketing in drawing travellers to the UK’s regions, citing the cultural appeal of figures like Harry Potter, Jane Austen and Richard III. She warned that the government’s current approach risks undermining tourism’s potential as an engine for regional economic growth.

While the WTTC report, produced in collaboration with Oxford Economics, showed that travel and tourism contributed £286 billion to the UK economy in 2024 — up 3.9 per cent from 2019 — the lack of spending from international tourists signals a missed opportunity.

A government spokesperson defended its strategy, stating that the UK remains one of the most visited countries in the world and that international tourism continues to generate billions for the economy. The spokesperson added that VisitBritain’s campaign “remains an effective tool driving economic growth,” and confirmed that a new national visitor economy strategy would be launched in the autumn, with the ambition of attracting 50 million international visitors annually by 2030.

Nonetheless, industry leaders fear that unless the government reverses some of its most damaging policies, particularly around taxation and visitor access, the UK’s tourism recovery will continue to lag behind that of its global peers.

Read more:

UK government accused of ‘sabotaging’ tourism as international visitor spending falls £2bn

Chancellor Rachel Reeves will travel to Washington this week to make the case for global free trade at the International Monetary Fund’s spring meetings, as Britain faces mounting pressure from punitive tariffs imposed by US President Donald Trump.

Reeves will use the high-profile forum — attended by global finance ministers and central bankers — to stress the importance of open trade for economic resilience and growth, both in the UK and worldwide. According to a senior government official, the UK’s heavy dependence on trade, with exports accounting for around 60 per cent of GDP, makes free trade not just a global concern but a national priority.

During the visit, Reeves is expected to meet US Treasury Secretary Scott Bessent — regarded as one of the more moderate voices within the Trump administration — to press for the removal of US tariffs on British car and steel exports. Allies say she will also push to accelerate talks on a potential UK-US trade deal, although she will make clear that any agreement must align with Britain’s national interest.

“Any deal that is able to be secured will always have front and centre British national interest,” Reeves said ahead of her departure.

The chancellor’s visit comes against a fraught economic backdrop, with the IMF expected to lower its global growth forecasts this week and issue fresh warnings over financial instability. Trump’s aggressive tariff regime has already caused significant strain on the world’s largest economies — including the EU, China and the US itself — and market turmoil is showing no signs of easing.

On Monday, while UK markets were closed for the bank holiday, US Treasury bonds and the dollar came under pressure from a sharp sell-off on Wall Street. The unrest was partly triggered by Trump’s renewed attacks on Federal Reserve chair Jerome Powell, who he accused of failing to cut interest rates. White House adviser Kevin Hassett has suggested Trump may be exploring ways to remove Powell from office — a move that would mark a major break with central bank independence.

While British officials are realistic about their slim chances of securing a full exemption from Trump’s 10 per cent global tariff, they are hoping to negotiate reductions on the more severe 25 per cent duties placed on specific UK goods. In an effort to find common ground, ministers have already offered several concessions to Washington, including targeted tax relief for US tech companies.

Reeves is expected to raise these points during bilateral talks in Washington, though expectations of an immediate breakthrough are low. “The timing is down to one man, so there is a degree of uncertainty there,” one UK government source said.

Trump and his advisers have made encouraging statements in recent days about the possibility of striking a trade deal with the UK. However, with the president’s policy unpredictability and his administration’s escalating pressure on trading partners, British officials remain cautious.

Ministers have prioritised a US-UK trade agreement as a cornerstone of the country’s international economic strategy, particularly as global protectionism rises. The Office for Budget Responsibility has warned that a full-scale trade war could shrink UK GDP by as much as 1 per cent by 2026-27.

In a bid to shield key industries, the government recently announced more flexible timelines for car manufacturers working towards the 2030 ban on new petrol and diesel vehicles. Other components of the UK’s industrial strategy — including support for the life sciences sector — are expected to be rolled out ahead of schedule as the government looks to boost growth and attract investment during a volatile economic period.

Read more:

Reeves heads to Washington to champion free trade amid Trump tariff tensions

The pound climbed to its highest level in seven months on Tuesday and gold prices surged to a record high above $3,500 per ounce, as investors dumped equities in favour of traditional safe-haven assets amid deepening fears over US political interference in monetary policy.

Sterling briefly broke above $1.34 against the dollar — its highest since September — before easing to $1.338. Against the euro, the pound gained 0.12 per cent to reach €1.163, on track for its longest winning streak against the US currency since 1971.

The market reaction came in response to a renewed barrage of criticism from President Donald Trump, who labelled Federal Reserve chairman Jerome Powell “a major loser” and demanded interest rate cuts, warning of a looming economic slowdown unless his calls were heeded.

Gold rallied sharply on investor jitters, climbing to a new high above $3,500 before settling at $3,469.13 per troy ounce in morning trading in London. Analysts cited growing concerns about the Federal Reserve’s independence as the key driver of the rush into gold.

“The broad sell-off was triggered by rising concerns over Fed independence,” analysts at Deutsche Bank said. “Yesterday’s market moves were the clearest sign yet of investor anxiety over the topic.”

Equity markets reflected the nervous sentiment. On Wall Street, the S&P 500 shed 2.36 per cent on Monday, while the Dow Jones Industrial Average fell 2.48 per cent and the tech-heavy Nasdaq dropped 2.55 per cent — marking one of the sharpest one-day declines this year.

Europe followed suit on Tuesday, with the pan-European Stoxx 600 index slipping 0.65 per cent. Germany’s Dax dropped 0.18 per cent, France’s CAC 40 fell 0.23 per cent, and Italy’s FTSE MIB slid more than 1.2 per cent.

London’s FTSE 100, however, bucked the broader trend. The index overcame early losses to climb 0.48 per cent, or 40 points, to 8,316.30, while the FTSE 250 edged up by 0.03 per cent to 19,255.82.

Commodity markets offered mixed signals. Brent crude rose 1.09 per cent to $66.98 a barrel, while WTI crude added 0.98 per cent to $63.70. Despite the day’s gains, both benchmarks remain significantly lower than at the start of the year.

Bitcoin, often seen as a digital hedge against inflation and market instability, rose 1.06 per cent to reach $88,429, maintaining its volatile upward momentum amid the global economic uncertainty.

With Trump’s intensifying pressure on the Fed and investors increasingly wary of political meddling in central bank decision-making, analysts warn that volatility could persist in the days ahead — particularly if Fed officials push back publicly or market expectations around interest rates shift dramatically.

Paul Nowak, general secretary of the Trades Union Congress (TUC), has defended the government’s proposed Employment Rights Bill, dismissing warnings from business leaders that it would place undue pressure on employers already dealing with tax hikes and rising wage costs.

Speaking to The Times, Nowak argued that the bill was long overdue and aimed at ending exploitative workplace practices. “This is about weaning a layer of employers off low-paid, insecure employment,” he said. “We need to ask ourselves if it’s sustainable to carry on with the current situation, where people are trapped in low-paid, precarious work. If we don’t, then we’ve got to bite the bullet at some stage.”

The legislation, which is currently progressing through Parliament and will soon enter the committee stage in the House of Lords, is facing stiff opposition from Britain’s five main business lobby groups. In an open letter to ministers, the CBI, Make UK, the Institute of Directors, the Federation of Small Businesses and the British Chambers of Commerce warned the bill could have “deeply damaging implications” for growth.

Among the bill’s proposals are day one rights against unfair dismissal, expanded sick pay, greater protections around shift patterns, enhanced powers for trade unions, and the near-total abolition of controversial fire-and-rehire tactics. Critics argue that these measures could increase employment costs by around £5 billion, according to the government’s own impact assessment.

Nowak rejected those concerns, pointing to similar fears raised when the minimum wage was introduced in the 1990s. “Critics of pro-worker legislation are proven wrong time and time again,” he said.

The business community is already grappling with significant financial pressures. April saw a £25 billion rise in employers’ national insurance contributions and a 6.7 per cent increase in the minimum wage. With President Trump’s new global tariffs fuelling concerns of an economic downturn, some employers fear further burdens could curtail hiring and slow growth.

There is speculation that the government may revise the bill’s most contentious element — day one unfair dismissal rights — by tying them to the end of a 90-day probationary period. Ministers have yet to confirm whether such a compromise will be adopted.

Despite these challenges, the government believes the bill could help reverse the UK’s poor track record on wage growth, with ministers hoping stronger protections will lead to greater job security and productivity.

Nowak also took aim at Donald Trump’s protectionist trade stance, calling him “an unreliable partner”. Nevertheless, he urged ministers to continue pursuing a UK-US trade deal while also resetting economic ties with the European Union in light of shifting global alliances.

He also praised the government’s emergency intervention to save British Steel from collapse after Chinese owner Jingye threatened to shut its Scunthorpe operations. “People in Scunthorpe will see the difference the government has made there. That plant would have closed otherwise,” he said.

Read more:

TUC chief defends workers’ rights bill and dismisses business cost concerns

Small and local businesses across the UK are increasingly adopting artificial intelligence (AI) tools to boost productivity and efficiency, according to new research that highlights the technology’s growing appeal for time-poor entrepreneurs.

A study led by Professor Ross Brown at the University of St Andrews Business School found that UK SMEs using AI tools could achieve productivity gains of between 27 and 133 per cent. The findings, based on interviews with nearly 10,000 businesses conducted by the Department for Business and Trade, suggest that AI has the potential to address the UK’s long-standing productivity challenges — particularly among underperforming small and medium-sized enterprises.

“AI potentially offers SMEs short cuts that provide quick productivity wins, like planning staff rotas or reducing food waste in a small restaurant,” Brown said. “These solutions are inexpensive and relatively easy to implement.”

The findings are supported by recent data from Faire, a wholesale marketplace for independent retailers, which found that 83 per cent of 300 surveyed small businesses had used AI tools, and more than one in three were using them daily. Only 10 per cent said they had no interest in adopting the technology.

One such adopter is Kate Tompsett, owner of Happy & Glorious, a Canterbury-based shop selling British-made gifts. With just two part-time staff, she uses AI platform ChatGPT to support her marketing efforts — from writing product descriptions to drafting blog posts.

“I find product descriptions really tedious, especially when I’ve got the same tote bag in eight colours,” she explained. “Google needs something unique for each, and ChatGPT helps me get started.” While she always rewrites the content to maintain her tone of voice, Tompsett described AI as “a kind of mini-me” that makes life easier. She’s now considering using it for scheduling and business planning.

Charlotte Stubbs, who runs Creativity, a gift shop in the coastal town of Sheringham, Norfolk, has taken a more cautious approach. Her younger sister uses built-in AI tools on social media platforms like Instagram, Facebook and TikTok to enhance post visibility. This has helped boost sales of popular items such as Jellycat soft toys.

However, Stubbs remains sceptical about relying too heavily on AI. “When you’re a small business like mine, I know what stock I need and when I need it — I don’t need a computer to tell me that,” she said.

Despite the varied levels of adoption, the trend is clear: AI is becoming a valuable tool for small businesses, particularly when used to tackle time-consuming tasks that don’t require specialist technical knowledge. For many owners, the technology provides a helping hand — or at least a head start — in running lean, agile operations in an increasingly digital world.

Read more:

Small businesses embrace AI for quick productivity wins, study finds

Fuel Ventures has led a £3 million investment round in 51toCarbonZero, a fast-growing climate-tech platform helping businesses transition to net zero while driving operational performance.

The round, which included support from angel investors, builds on Fuel Ventures’ previous backing and reflects the company’s strong growth trajectory.

51toCarbonZero’s cloud-based platform helps organisations measure, manage and reduce their carbon emissions, supporting a wide range of sectors including advertising, entertainment, logistics, automotive, finance, food and beverage, and sport. The new funding will enable the company to scale its operations across the UK, Europe and the US, and deliver advanced platform features powered by artificial intelligence.

Mark Pearson, Founder of Fuel Ventures, said: “Our continued investment in 51toCarbonZero underscores our confidence in their mission and the impressive progress they’ve made since our previous investment. The 51toCarbonZero team have developed a platform that not only addresses the urgent need for emissions management but also empowers companies to take actionable steps towards sustainability. We’re excited to support their expansion into new markets and industries.”

As sustainability becomes a strategic imperative for corporates worldwide, 51toCarbonZero aims to make the path to net zero more accessible and data-driven. The business is enhancing its platform’s AI capabilities to make carbon management simpler, more predictive, and seamlessly integrated into business processes.

Professor Neil Woodcock, Co-Founder and Executive Chairman of 51toCarbonZero, commented: “This investment marks a pivotal moment for 51toCarbonZero. With Fuel Ventures’ continued support, we’re poised to extend our reach and enhance our platform’s capabilities, particularly through AI integration. Our mission is to simplify the path to net zero for companies worldwide so we can help reduce emissions by 500 million tonnes of CO₂e, and this funding brings us closer to achieving that.”

Read more:

Fuel Ventures backs £3m investment in 51toCarbonZero to drive global expansion

More than eight million people will find themselves paying higher rates of income tax by the end of the decade due to the long-term freezing of tax thresholds, according to the UK’s official forecaster.

In projections released alongside the March spring statement, the Office for Budget Responsibility (OBR) said that 8.3 million people would be pulled into the tax system or pushed into higher tax bands by 2029-30 as a result of so-called fiscal drag — a consequence of earnings rising while tax thresholds remain fixed.

Fiscal drag occurs when tax bands do not rise in line with inflation or wages, effectively increasing the government’s tax take without raising headline rates. Often referred to as a “stealth tax”, it can go unnoticed by many workers, who only feel the impact once larger portions of their income are taxed at higher rates.

Threshold freezes, introduced by Rishi Sunak in 2021 during his time as chancellor, were intended to restore public finances post-pandemic. The policy has since remained in place, despite record wage growth and inflation. Had tax bands kept pace with inflation, the number of income taxpayers would be 37 million by 2029-30, according to the OBR — instead, it is forecast to hit 41.1 million.

Think tanks are divided over the approach. The Institute for Fiscal Studies has described frozen thresholds as a “stealthy” method of raising revenue, while the Resolution Foundation argues that it is a more progressive way to increase government income, particularly as higher earners end up contributing more.

Chancellor Rachel Reeves has committed to ending the freeze from 2028-29. But until then, the OBR forecasts that the UK’s overall tax burden will continue to rise, hitting its highest level since the Second World War. This comes despite the Labour government’s pledge not to raise the main rates of income tax, national insurance or VAT for “working people”.

In her first budget last October, Reeves announced a £25 billion increase in employers’ national insurance contributions and confirmed the freeze would remain in place for several more years. While her March spring statement included £5 billion of welfare-focused spending cuts, she retained a £9.9 billion margin under her main fiscal rule — to fund day-to-day spending from tax revenue.

That narrow fiscal headroom has prompted concerns in financial markets and among economists, particularly with pressure mounting for increased government spending in areas such as defence, health, and long-term growth investments. The situation is expected to place further strain on the chancellor ahead of the autumn budget.

Responding to the fiscal drag forecasts, the Treasury said: “This government inherited the previous government’s policy of frozen tax thresholds. At the budget and the spring statement, the chancellor announced that we would not extend that freeze. We are also protecting payslips for working people by keeping our promise to not raise the basic, higher or additional rates of income tax, employee national insurance or VAT. That’s the ‘Plan for Change’, protecting people’s incomes and putting money into people’s pockets.”

The fiscal drag effect has been intensified by a period of rapid wage growth and high inflation. Wage growth peaked at 8.9 per cent in 2022 as inflation reached a 40-year high of 11.1 per cent in October of that year. Although inflation has since eased to 2.6 per cent, the legacy of frozen thresholds means millions will continue to feel the pinch in the years ahead.

Read more:

Fiscal drag to push 8.3 million more Britons into higher tax brackets by 2030